Post

IG, established in the UK in 1974, is one of the biggest CFD brokers in the world. It is regulated by several bodies globally, including top-tier regulators like the UK's Financial Conduct Authority (FCA) and Germany's Federal Financial Supervisory Authority (BaFin). IG Group is listed on the London Stock Exchange.To get more news about IG Pros and Cons, you can visit wikifx.com official website.

IG is considered safe because it is listed on a stock exchange, discloses its financials and is overseen by top-tier regulators.

Disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 79% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. CFDs are not provided for US clients. Forex trading involves risk. Losses can exceed deposits.

IG pros and cons

IG has a well-designed and user-friendly web trading platform that is easy to customize. You will find many useful educational tools on the website. Funding and withdrawing money is easy and there are multiple options.

On the other hand, IG's trading fees are high for forex and stock CFDs. The product portfolio is limited, as in most countries IG offers only CFD and options trading. Customer support could be better.

How we ranked fees

We ranked IG's fee levels as low, average or high based on how they compare to those of all reviewed brokers.

First, let's go over some basic terms related to broker fees. What you need to keep an eye on are trading fees and non-trading fees.

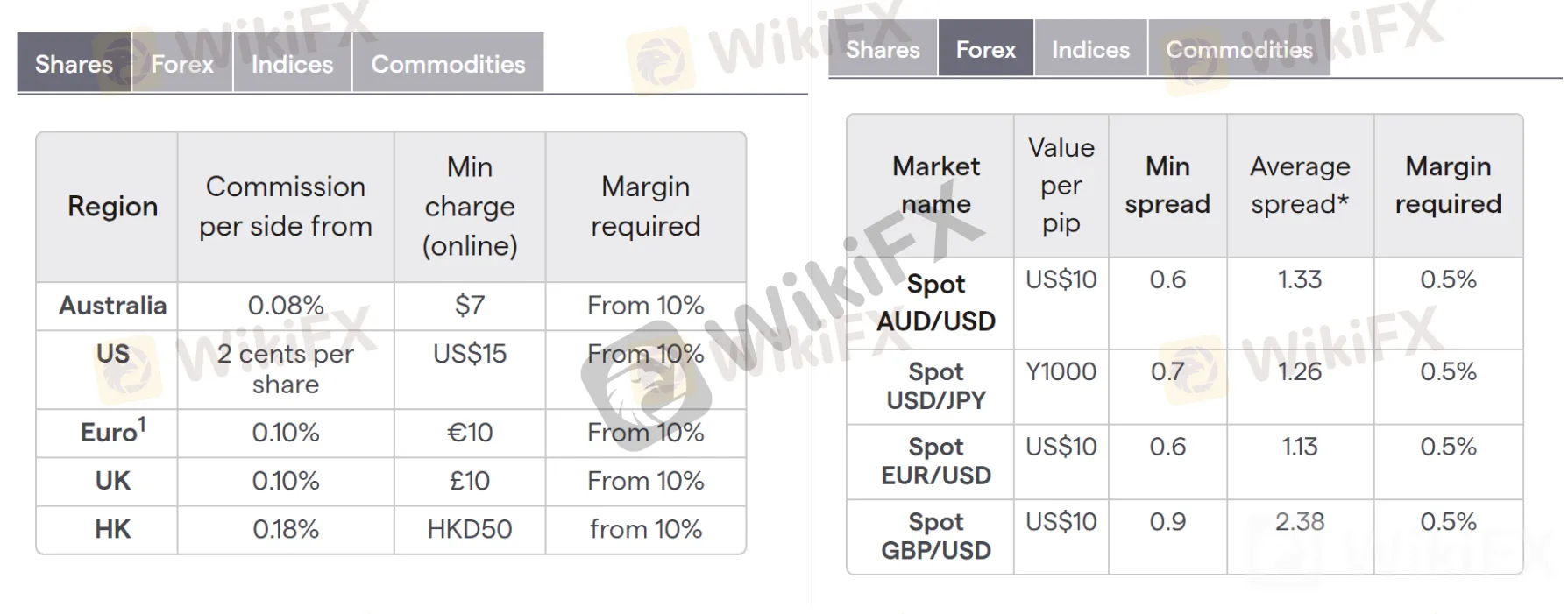

In the sections below, you will find the most relevant fees of IG for each asset class. For example, in the case of forex and stock index trading the most important fees are spreads, commissions and financing rates.

We also compared IG's fees with those of two similar brokers we selected, eToro and XTB. This selection is based on objective factors such as products offered, client profile, fee structure, etc. See a more detailed rundown of IG alternatives.

We know it's hard to compare trading fees for CFD brokers. So how did we approach the problem of making their fees clear and comparable? We compared brokers by calculating all the fees of a typical trade for selected products.

IG has mostly average CFD trading fees. Stock index CFD fees are rather favorable but for stock CFDs the broker charges high fees, mainly because of high minimum fees ($15/£10). In the UK and Ireland, you can use spread betting instead of CFDs.

At IG, commission for the UK and US markets depends on how many trades you made in the preceding months. For example, if you traded UK shares more than two times, your commissions per trade for UK shares will be £3 instead of £8 for the next month. In the case of US shares, if you traded more than two times, you will be able to trade commission-free next month.

komentarze

Opis

Kategorie

Tagi