Tagi - forex

The world of Forex trading is a highly lucrative one, reeling in millions of dollars in profits year after year. In similar breadth, it is also rife with the opportunistic and downright criminal, keen on taking advantage of information gaps and hardworking people with gullible schemes leading you nowhere. It can be hard to separate the wheat from the chaff, given the difficulties in the process of discerning real from fake traders. The WikiFX app gives you all the necessary tools and information to make this process easier, so you can make a sound investment decision in the forex market.To get more news about WikiFX, you can visit wikifx news official website.

Available for both Android and iOS systems, WikiFX ensures your Forex trading peace of mind in the following ways:

Round the clock Forex News: Stay ahead of the Forex headlines and be in the know of scams before they get to you. There are tons of other useful content regarding the global forex industry as well.

Consistently accurate forex markets, entailing essential statistics such as chart analysis.

Reliable and authoritative data sources you can trust. Mined from worldwide regulatory institutes, you can rest assured in the data accuracy of WikiFX.

Comprehensive information from every forex angle, including trade rules, account details, and much more to ensure accurate verification.

More than 5000 brokers across 30 regions and countries. No matter your location, you can get all you need in a few clicks.

How WikiFX works

Get to know whether your broker is legit or not, via a quick search in the search panel at the "home" tab. Via the WikiFX appraisal, you can also determine the risk involved. If you're short on broker ideas, click on "express" at the bottom bar, and you'll get a list of the top brokers in the industries for your next forex journey. The financial news section offers real-time updates on the market, among other useful content.

Why WikiFX is better than the crowd

With a tremendous amount of data to govern your Forex trading, WikiFX is the Wikipedia equivalent for the market. It excels in both the quantity and quality of information, offering proven data sourced from field surveys, and trusted institutions. It's also one of the few apps of its kind with such a massive number of broker options, more than 5000 in upwards of 30 countries and regions.

WikiFX's consistent reliability means you no longer need to grope in the dark when trading, instead see all the options on the table and get full insight as to which is the best way to go.

Ensuring safe trading for all, WikiFX-Global Broker Regulatory Inquiry App is a must-have Forex bodyguard for all!

Much like the Steel vs Cast Aluminum vs Flow Formed Cast article, you'll probably want to read it and the Wheel Basics articles before continuing to read this article. A few terms may get glossed over here only because they are fully referenced in those previous ones. So, if you happen to get lost on a term, head back to those to learn more.To get more news about Car wheel, you can visit nnxwheels.com official website.

In most cases, the aluminum used in a forged wheel and a cast wheel are the same alloy composition - either AISI 6061 or AISI 6082. Where they separate is how the wheel shape is formed. Instead of melting the aluminum alloy into a liquid form and flowed into a cast mold, it's a billet of aluminum.

That term gets tossed around quite a lot when you talk about aluminum parts. What it refers to is that the aluminum (and steel when you talk about "billet steel") is extruded by continuous casting or hot rolling into square, flat, or round stock that your aluminum part is made of.

That extrusion process creates a stronger material from the get-go and is why a billet part is of a higher quality and stronger in nature. The metal grains are compressed, ordered, and lengthened as you extrude it and is how the metal gains strength. Once that process is done it's on to the forging line.

Not all forging processes will be like this, but most will generally be done in the following way. First, the billet is heated and pressed forged into its initial shape. It has a bit of its wheel face designed in but there is no barrel, just a skirt of aluminum.

Here, it's very similar to the flow formed cast wheel process in that the piece is sent to another machine where it is heated. A forming die is then pressed to form the wheel barrel as it spins on another machine. The flanges, bead seats, and drop well are all formed at this point.

Before receiving any heat treatment to get the wheel to its final hardness, the wheel is cold spun, and any flashing created during the hot forming process is removed. The heat treating is done so that the wheel is hard but no so that it becomes too brittle.

You want a wheel that is rigid and that is what the heating process is designed to achieve. After treatment, the wheel is then machined, media blasted to remove any corrosion that may have built up, and finished by painting, powder coating, or polishing and sealing.

The use of a single billet of aluminum to create an entire wheel creates a wheel of unequaled strength for the final weight. It's the choice of wheel design in racing where exotic materials aren't allowed or just aren't feasible. As the forging process becomes cheaper and better, we're starting to see more forged aluminum wheels on Jeeps where it was more common to hear about the beadlock ring being the only forged aluminum part.

In addition to the weight of wheels continuing to go down, we're also starting to see the same trend in our off-road tires. Even large MT tires today weigh less than their counterparts of just a few years ago by using materials other than steel to create the tire carcass. Even so, you still want to decrease the rotational and un-sprung weight at your Jeep's hubs to decrease the effort your engine requires to turn them over.

It's here where small changes can have very big impacts on the performance of your rig. It's not just sports cars that will see these advantages. The less weight at the axle is horsepower the engine can transfer to the ground instead of trying to turn the wheel and tire. Less weight is less rotational momentum that your brakes must stop, though that is a very, very small gain when compared to the benefits to power and acceleration.

Carbon fiber is the miracle material that made its bones in the automotive scene with McLaren race cars in the early 1980s. Since then, it has found its way into body panels and monocoques for supercars, as well as all kinds of interior and exterior trim items for cars with sporty intentions. Most recently, it's been used for wheels on cars such as the Ford GT, Ford Shelby Mustang GT350, Porsche 911 Turbo S, and Ferrari 488 Pista.To get more news about Alloy rims , you can visit nnxwheels.com official website.

Now, the strong, lightweight material is teaming up with aluminum for new aftermarket wheels from Forgeline. These aren't the only carbon-fiber and aluminum wheels on the market. Brixton also offers similar wheels for similar prices.

Forgeline's Carbon + Forged series wheels are offered in three styles in 20- and 21-inch sizes. The 20-inch wheels are offered in 9.5-, 11-, and 12-inch widths, while all 21s are 12.5 inches wide. According to company president, Dave Schardt, the offsets range from 0 to +75 millimeters and the available bolt patterns are 5x108, 5x112, 5x114.3, 5x120, 5x120.7, 5x130, and 6x114.3. They were designed for use on all current Porsches, Ferraris, Corvettes, and McLarens, but Schardt says they will also work on Teslas, Mercedes-Benzes, BMWs, and various muscle cars.

Each wheel has a center that is CNC machined from 6061-T6 forged aluminum and bolted to a carbon-fiber barrel made by the British wheel manufacturer Dymag. That makes the new Carbon + Forge series two piece wheels, which can be beneficial down the line for any necessary repairs.

The inside portion of the barrel is finished in a glossy carbon-fiber weave. In addition to the three styles, Forgeline offers several finishes for the wheel centers, anything from fully polished to tints and powder coats in graphite, silver, gunmetal, red, yellow, blue, gold, black, gray, and copper.

The wheels are quite costly, though not as pricey as the pure carbon-fiber wheels we've seen. Prices range from $3,850 for a 20-inch wheel to $4,350 for a 21. The various finishes may come at no cost or range up to $525 per wheel, the latter for a polished face with brushed accents. Brixton wheels start at $16,000 per set.

Forgeline notes that the wheels have low static and inertial masses. The 20-inch wheels weigh only 16.5 pounds, and Schardt says they will save 5 or more pounds per wheel versus comparable alloy wheels. The company also says they offer minimal deflection and excellent fatigue strength, and they exceed all SAE and TUV test specifications. However, Forgeline also advises that they are for street use only and not for the track, though Schardt noted that a motorsport version will be offered later.

The company announced the Carbon + Forged line at the 2016 SEMA show, then signed the deal with Dymag last year. The wheels are on sale now and will begin shipping at the end of August.

The aluminum alloy wheel market size is expected to grow by USD 3.41 billion from 2020 to 2025 progressing at a CAGR of 4.43% according to Technavio's latest market report. The advent of carbon fiber alloy wheels is the key market trend driving the aluminum alloy wheel market growth. Carbon fiber alloy wheels are one of the main substitutes for aluminum alloy wheels as carbon fiber is stronger than aluminum and half its weight. Although the aluminum alloy wheel is lightweight, the processing of an aluminum alloy wheel can affect its strength and stiffness. Hence, aluminum alloy wheels can deform under a slight impact, whereas carbon fiber alloy wheels remain intact. Moreover, carbon fiber wheels offer better performance than aluminum alloy wheels even if the weight of a carbon fiber alloy wheel is reduced by half of that of an aluminum alloy wheel. Carbon fiber alloy wheels help in meeting emission targets due to their lightweight feature. Thus, the increase in the adoption of fiber alloy wheels will impact the global aluminum alloy wheel market.To get more news about Car wheel, you can visit nnxwheels.com official website.

The competitive scenario provided in the Aluminum Alloy Wheel Market report analyzes, evaluates, and positions companies based on various performance indicators. Some of the factors considered for this analysis include the financial performance of companies over the past few years, growth strategies, product innovations, new product launches, investments, growth in market share, etc.

The aluminum alloy wheel market share growth in the passenger cars segment will be significant for revenue generation. Automakers are increasingly adopting aluminum alloy wheels due to their benefits in terms of higher fuel efficiency and aesthetic appeal. Hence, the demand for aluminum alloy wheels will increase in the passenger cars segment during the forecast period.

The aluminum alloy wheel market is fragmented and the vendors are deploying growth strategies such as using new materials for manufacturing aluminum alloy wheels to compete in the market. The aluminum alloy wheel market report also offers information on several market vendors, including Accuride Corp., BORBET GmbH, CITIC Ltd., and CMS Jant ve Makina San. AS, Enkei Corp., Foshan Nanhai Zhongnan Aluminum Wheel Co. Ltd., Howmet Aerospace Inc., Iochpe-Maxion SA, RONAL AG, and Superior Industries International Inc. among others.

Reasons to Buy Aluminum Alloy Wheel Market Report:

CAGR of the market during the forecast period 2021-2025

Detailed information on factors that will assist aluminum alloy wheel market growth during the next five years

Estimation of the aluminum alloy wheel market size and its contribution to the parent market

Predictions on upcoming trends and changes in consumer behavior

The growth of the aluminum alloy wheel market across APAC, Europe, North America, South America, and MEA

Analysis of the market's competitive landscape and detailed information on vendors

Comprehensive details of factors that will challenge the growth of aluminum alloy wheel market vendors

Learn to Trade Forex

With benefits like 24-hours trading, high liquidity and low transaction costs, the foreign exchange market, or forex market, attracts experienced and novice traders alike. The massive growth of the currency market has seen many traders jump in before they've taken the time to learn to trade forex and this can be a mistake. If you want a quick but comprehensive understanding of what is forex, how the market works and why it's important to open a demo account, then read our comprehensive guide on how to trade forex.To get more news about forex education, you can visit wikifx.com official website.

Forex Trading for Beginners

Like most specialised industries, forex trading comes with its own jargon and set of terms. There are certain forex trading concepts you should be familiar with to understand the dynamics of this unique market, identify opportunities and trade successfully.

Currency Exchange Rates: Bid, Ask and Spread

To understand what is forex, you may first need to open a demo account and understand the concept of currency exchange rates. The price of a currency is always quoted in terms of another currency. For instance, EUR/USD would be the price of a Euro expressed in terms of the US dollar. In other words, it represents the number of US dollars you can exchange for €1. If for example, the EUR/USD is 1.1749, it means €1 can be exchanged for US$1.1749.

You may notice, however, that in forex trading, price quotes on trading platforms are showed with two rates not just one. For instance, the EUR/USD exchange rate may be displayed like this: 1.1749 / 51 or 1.1749 / 1.1751. The first figure (to the left) is known as the bid price and represents the maximum price at which the market is willing to buy the US dollar. So, if you sell €1, you will receive US$1.1749. The second figure (to the right) is known as the ask price and represents the minimum price at which the market is willing to sell the US dollar. So, if you buy €1, you will need to pay US$1.1751.

The lower, or tighter, the forex spread, the more liquid a market is said to be and the lower the implied cost of trading. Spreads in stock trading are typically much higher than spreads in forex trading.

What is a Forex Trading Platform?

As a beginner in forex trading, one of your first decisions is which forex trading platform to choose. The trading platform is the software that gives you access to the forex market and seamless trade execution. A robust forex trading platform facilitates fast and safe trading, while also providing various options for trade analysis, customisation and automated trading.

The award-winning Orbex MT4 platform has an extremely user-friendly interface with highly powerful software running in the background. The platform offers advanced real-time charting options, free forex signals, high flexibility and enhanced security and stability.

Trade from the comfort of your home, with the Windows or Mac version of the Orbex MT4 platform, or trade on the go by downloading the Android or iOS version. The cloud-based Orbex WebTrader app provides free, instant and secure access to your account from anywhere and on any device.

Leverage in Forex Trading

Leverage is essentially a loan that brokers offer traders, so they can place trades that are of a higher value than the funds they currently have in their trading account. As a beginner in forex trading, it's critical to understand the benefits, as well as the pitfalls, of leverage.

Leveraging, also known as trading on margin, gives you the opportunity to multiply potential profits, providing the market moves in your favour. Remember there is no guarantee that the market will, in fact, move in your favour. If the market moves in the opposite direction, leveraging will multiply the losses you incur. Forex leverage is therefore a powerful tool, but one which needs to be used with caution.

Risk Management in Forex Trading

The forex market offers significant opportunities to make profits. However, every opportunity is accompanied by a degree of risk. While risk cannot be completely removed, there are some risk management techniques that traders can use to hedge risks. These techniques are particularly important when using forex leverage.

Stop-Loss Orders

A stop-loss order is placed to minimise losses in the event the currency exchange market moves against you. The exchange rate of a currency pair moves up and down continuously throughout the day, even within a fraction of a second. It is unwise to exit a trade at the slightest drop in the exchange rate of your currency pair. However, if the rate drops below a certain point, you may choose to exit. With online forex trading, you can set the currency rate at which to exit the market well in advance. This is exactly what a stop-loss order allows you to do. Essentially, a stop-loss order acts as a safety net to minimise your losses.

When you open a position, or set a pending order, you can also specify the stop-loss price. If the forex market moves against you and the exchange rate reaches the low price you've specified, the trade is automatically closed, limiting your losses.

Take-Profit Orders

It's easy to feel optimistic when the market is moving in your favour. However, in any form of currency trading, it's important to make objective decisions, based on logic and discipline. A take-profit order can be considered as a predetermined exit strategy that comes into effect when the market moves in your favour.

Similar to a stop-loss order, a take-profit order is executed automatically at a price specified by you. The difference being, a take-profit order is executed at a currency rate better than the current market rate, while a stop-loss order automatically closes a trade at a currency rate worse than the current market rate. This means that your trade closes on a high if you are not at your desk and able to stop it before it falls.

The Foreign currency Exchange (FOREX) market is the largest and most liquid financial market in the world. The average daily trade in the global FOREX markets exceeds US$1.9 trillion (Source: the Triennial Central Bank Survey of Foreign Exchange and Derivatives Market Activity conducted by the Bank for International Settlements (BIS) in April 2004, and published in March 2005). These huge funds are traded by governments, banks, and large institutions. For comparison, the biggest stock market on the Earth - NYSE Group (The New York Stock Exchange), has a daily trading volume of approximately $86.8 billion (Source: NYSE Group, Inc. 2006). FOREX has a 18.4% average growth rate per year since 1989. It offers trading 24 hours a day, five days a week, non-stop over Internet. This kind of massively liquid and long uninterrupted trading hours mean that under normal conditions there is no problem entering or exiting a trade.To get more news about forex robots trading, you can visit wikifx.com official website.

But, in this huge market, as the story goes, at least 90% of new FOREX traders lose all their money within their first 3 months of trading. Why? Most losing traders who inquire about FOREX trading are quite intelligent, they just lack the right tools, the "Secret Weapons" to win. They are not beaten by other traders, they simply are beaten by themselves, by humans' weaknesses.

1. What is the first big weakness of human beings? if I say it should be "greed", is there anybody will disagree? Many times we have got 1% profit, but we feel it is not fat enough. We want more, 2% or 3% will be better. While the profit really goes to 3%, we will think how about 10%? Not enough forever. But the market is so volatile, especially in Forex market, we often encounter this depressive situation: profit turns into negative from positive. and this kind of depression happens again and again.

2. Fear. All people have fear. In Forex trading, currency rate is easily jumping or dropping hundreds of pips. Few of people can make sure how the market will go. In Forex market, people all use leverage to trade, from 50:1 to 500:1, leverage will enlarge the profit or loss from 50 times to 500 times. Leverage is the wonderful feature of Forex, and it lead fear into people's heart too. If the market goes against people, big drawdown comes, their fear comes too. Is there anybody not scary to lose money? Under the pressure of fear, people easily and often make wrong decisions, stop loss too early, then regret soon.

3. Lack of confidence. Seems better than fear, huh? But it is still not a good thing. Many times human traders are so happy once they see a little bit profit in their accounts. They are worrying what if the profit turns into loss? People always take a tiny profit and run, then regret while they see the market goes further and further along the right track. If they were confident, they would have made ten times or even a hundred times of profit.

4. Hesitation. Not only newbies, but also old-hands easily hesitate to act in Forex market. You've probably heard the saying "past performance does not predict future performance". Even a very experienced trader who has made many successful trades in his/her history, while he or she is facing a new situation, needs thinking twice before making a so simple decision: Buy or Sell? For new traders or amateurs, they need longer time to think, and this kind of hesitation always leads them to confusion and missing the best and fleeting chance.

5. Weariness. How many people can keep working for 24 hours? No sleep, no rest? How about 48 hours, 72 hours, etc? Even an iron man can not use his eyes watching computer monitor, his brain thinking fast changing questions and his hands calculating complex formulas, day and night, 24 hours a day, 6 days a week, non stop. Especially, no mistakes allowed!

6. Negligence. Have you ever got trouble just because of a small negligence? such as took a wrong bus, missed an exit on highway, dialed a wrong number, misunderstood boss' order, ignored a no-parking sign, omitted a whole page of questions in an examination, left resume at home while a vital interview, misspelled a keyword in a quote form for a VIP customer, etc. Hi, man, when was the last time you forgot your mama's birthday, or worse, the wife's, or the worst, girl friend's? Mama always forgive your negligence. Wife... well, it depends. Girl friend? Huh, wish you good luck.

7. Lack of discipline. Humans always think that we are smarter than machines. Sure we are. Not only we are smarter, we have freedom too. But everything has its nature, character, and rules. Rule means discipline. If we just feel smart and free in Forex trading, making decisions based on our feelings or knowledge only, and ignore discipline, there will be endless disasters waiting us ahead. Forex trading is like fighting in war, soldiers can not survive in war without discipline, neither can traders in Forex market. While we have to stop loss we must cut off and run, in spite of how bloody and painful it is, when we must take profit we can not hate the profit is too small. Discipline is discipline, perhaps some smarties can win a while, but only those people can keep obeying discipline forever can win forever.

8. Inconsistency. Long term or short term? buy or sell? prosperity or depression? over bought or over sold? high or low? support level or resistance level? fundamental analysis or technical analysis? including automated trading or manual trading? etc. There are too many inconsistent news, facts, information and methods, strategies in Forex market, easily cause human traders make inconsistent judgments and decisions. And these inconsistencies will cause only one same result: failure!

Bollinger Bands are a powerful technical indicator created by John Bollinger. The bands encapsulate the price movement of a stock, providing relative boundaries of highs and lows. The crux of the Bollinger Band indicator is based on a moving average that defines the intermediate-term "trend" based on the time frame you are viewing.To get more news about bollinger band, you can visit wikifx.com official website.

But how do we apply this indicator to trading and what are the strategies that will produce winning results?

In this post we'll provide you with a solid foundation on the bands, plus six trading strategies you can test to see which works best for your trading style.

Most stock charting applications use a 20-period moving average for the default settings. The upper and lower bands are then a measure of volatility to the upside and downside. They are calculated as two standard deviations from the middle band.

In essence, the Bollinger Band indicator was created to contain price the vast majority of the time. In fact, Investopedia claims that the bands actually contain the price 90% of the time [2].

If you are new to trading, you are going to lose money at some point. This process of losing money often leads to over-analysis. While technical analysis can identify things unseen on a ticker, it can also aid in our demise as traders.

In the old days, there was little to analyze. Therefore, you could tweak your system to a degree, but not in the way we can continually tweak and refine our trading approach today.

We make this point in regard to the settings of the bands. While the configuration is far simpler than many other indicators, it still provides you with the ability to run extensive optimization tests to try and squeeze out the last bit of juice from the stock.

The problem with this approach is that after you change the length to 19.9 (yes people will go to decimals), 35 and back down to 20; it still comes down to your ability to manage your money and book a profit.

Our strong advice to you is not to tweak the settings at all. It's better to stick with 20, as this is the value most traders are using to make their decisions, versus trying to look for a secret setting.

#1 STRATEGY - DOUBLE BOTTOMS

The first bottom of this formation tends to have substantial volume and a sharp price pullback that closes outside of the lower Bollinger Band. These types of moves typically lead to what is called an "automatic rally." The high of the automatic rally tends to serve as the first level of resistance in the base building process that occurs before the stock moves higher.

#2 STRATEGY - REVERSALS

Another simple, yet effective trading method is to fade stocks when they begin printing outside of the bands. We'll take this one step further and apply a little candlestick analysis to this strategy.

For example, instead of shorting a stock as it moves up through its upper band limit, wait to see how that stock performs. If the stock goes parabolic or gaps up and then closes near its low while near the outside of the bands, this is often a good indicator that the stock will correct on the near-term.

#3 STRATEGY - RIDING THE BANDS

The single biggest mistake that many Bollinger Band novices make is that they sell the stock when the price touches the upper band or buy when it reaches the lower band.

Bollinger himself stated a touch of the upper band or lower band does not constitute a buy or sell signal. In his book, John states, "During an advance, walking the band is characterized by a series of tags of the upper band, usually accompanied by a number of days on which price closes outside of the band."

#4 STRATEGY - BOLLINGER BAND SQUEEZE

John created an indicator known as the band width. This Bollinger Band width formula is simply (Upper Bollinger Band Value - Lower Bollinger Band Value) / Middle Bollinger Band Value (Simple moving average).

The idea, using daily charts, is that when the indicator reaches its lowest level in 6 months, you can expect the volatility to increase. This goes back to the tightening of the bands that I mentioned above. This squeezing action of the Bollinger Band indicator often foreshadows a big move.

Forex signals can be defined as "buy" and "sell" suggestions and, in conjunction with technical and fundamental analysis, they provide information on the best time and price to enter a trade and profit from the predicted move in price.To get more news about free forex signals, you can visit wikifx.com official website.

Understanding when to open or close a trade is key to successful forex trading and is a crucial part of learning how to trade currency pairs. Professional traders have years of experience analysing chart patterns and scrutinising current events and news announcements to help them assess when to open or close a forex position. Technical analysts will look for signals to guide them when entering and exiting trades.

The main difference between manual and automated forex signals is that manual signals are generated by a person who often is a professional trader. Automated forex signals, on the other hand, are generated by computer software that analyses the market price action based on algorithms.

Free and paid forex signals

Some providers offer free signals (either as a trial or for an unlimited period of time), while other providers offer paid forex signals.

Entry and exit forex signals

Some signals providers only give entry signals, meaning that they provide a signal on when to open a position. Others provide only exit signals, meaning that they provide a signal on when to close a position.

Algorithmic forex signals

Some traders use trading robots or Expert Advisors (EAs) for their forex signals. An EA is a set of rules or an algorithm that places trades when specific criteria are met. EAs can be created by anyone with enough technical knowledge and are often sold online. Find out about automated trading with the MT4 platform.

Benefits of forex signals

They are time efficient. In forex trading, researching and analysing are very important skills that require a lot of time. With forex signals, traders don't have to necessarily spend time analysing charts and patterns. However, you should still do your own independent research and not rely solely on signals.

They help to minimise risks. If used correctly, forex trading signals can help you reduce the risk of losses by suggesting the right time to either enter or exit a trade and consequently where to place your stop loss.

It is a quick learning curve. Forex signals can help traders to understand how these signals correspond to their trades.

Are forex signals reliable?

With a trusted forex signals provider, forex signals can be very reliable source of information. However, it should be noted that, there are some unscrupulous and less reliable services out there so it is important to exercise diligence when using a forex signal provider.

The biggest disadvantage of using trading signals is that the forecast is not always accurate. However, this risk can be minimised by taking some precautions, such as training and practise. Clients of CMC Markets can trade with £10,000 worth of virtual funds on our demo account, without risking real money. Register for a demo account now.

Traders often compare forex vs stocks to determine which market is better to trade. Despite being interconnected, the forex and stock market are vastly different. The forex market has unique characteristics that set it apart from other markets, and in the eyes of many, also make it far more attractive to trade.To get more news about forex vs. stock, you can visit wikifx.com official website.

When choosing to trade forex or stocks, it often comes down to knowing which trading style suits you best.But knowing the differences and similarities between the stock and forex market also enables traders to make informed trading decisions based on factors such as market conditions, liquidity and volume.

1) Volume

One of the biggest differences between forex and stocks is the sheer size of the forex market. Forex is estimated to trade around $5 trillion a day, with most trading concentrated on a few major pairs like the EUR/USD, USD/JPY, GBP/USD and AUD/USD. The forex market volume dwarfs the dollar volume of all the world's stock markets combined, which average roughly $200 billion per day.

Having such a large trading volume can bring many advantages to traders. High volume means traders can typically get their orders executed more easily and closer to the prices they want. While all markets are prone to gaps, having more liquidity at each pricing point better equips traders to enter and exit the market.

2) Liquidity

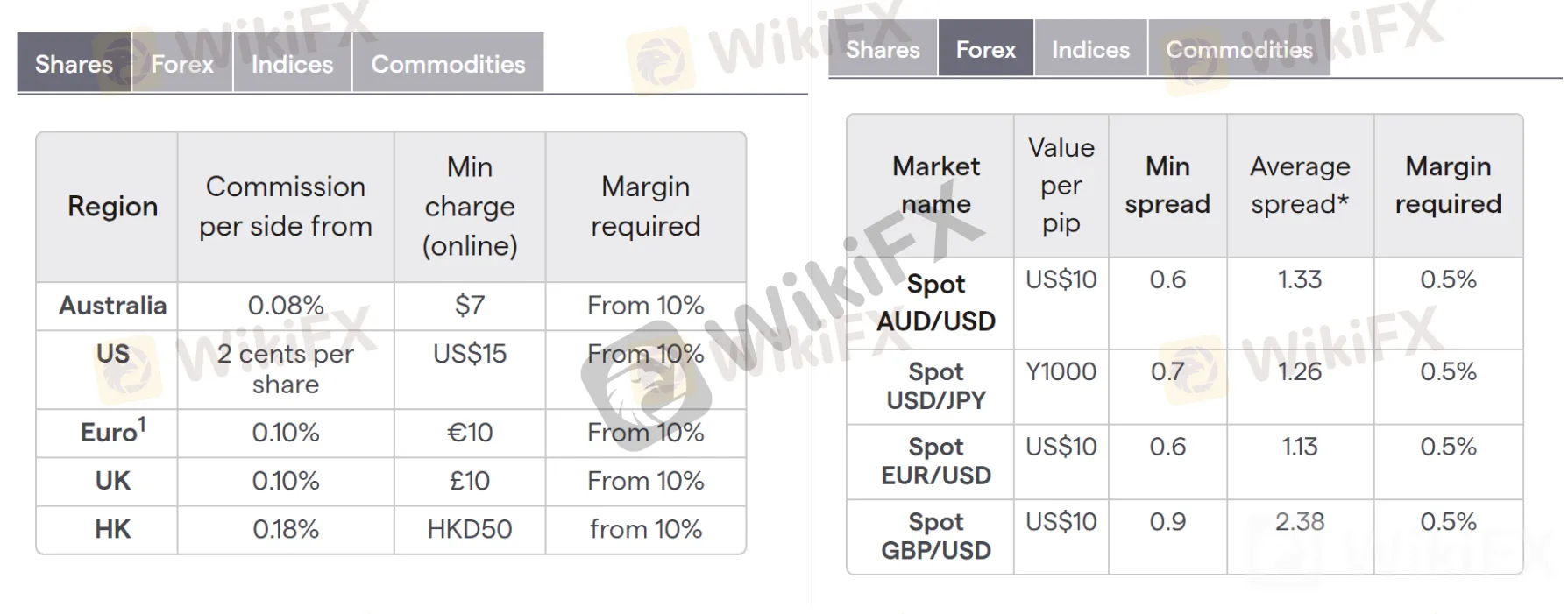

A market that trades in high volume generally has high liquidity. Liquidity leads to tighter spreads and lower transaction costs. Forex major pairs typically have extremely low spreads and transactions costs when compared to stocks and this is one of the major advantages of trading the forex market versus trading the stock market. Read more on the differences in liquidity between the forex and stock market.

3) 24 Hour Markets

Forex is an over the counter market meaning that it is not transacted over a traditional exchange. Trading is facilitated through the interbank market. This means that trading can go on all around the world during different countries business hours and trading sessions. Therefore, the forex trader has access to trading virtually 24 hours a day, 5 days a week. Major stock indices on the other hand, trade at different times and are affected by different variables. Visit the Major Indices page to find out more about trading these markets-including information on trading hours.

4) Minimal or no commission

Most forex brokers charge no commission, instead they make their margin on the spread - which is the difference between the buy price and the sell price. When trading equities (stocks) or a futures contract, or a major index like the S&P 500, often traders must pay the spread along with a commission to a broker.

Forex spreads are quite transparent compared to costs of trading other contracts. Below you will see the spread of the EUR/USD highlighted inside of the executable dealing rates. The spread can be used to calculate the cost for your position size upfront prior to execution.

5) Narrow focus vs wide focus

There are eight major currencies traders can focus on, while in the stock universe there are thousands. With only eight economies to focus on and since forex is traded in pairs, traders will look for diverging and converging trends between the currencies to match up a forex pair to trade. Eight currencies are easier to keep an eye on than thousands of stocks.

How can I transition from forex trading to stock trading?

To move from forex to stock trading you will need to understand the fundamental differences between forex and stocks. When you boil it down, forex movements are caused by interest rates and their anticipated movements. Stocks are dependent on revenue, balance sheet projections and the economies they operate in amongst other things. Find out more on how to transition from forex to stock trading.

Are there any differences between forex and commodities trading?

Forex and commodities differ in terms of regulation, leverage, and exchange limits. Forex markets are a lot less regulated than commodities markets whilst commodities markets are highly regulated. In terms of leverage, it exists in both the forex and commodities market, but in the forex market it is more popular due to greater liquidity and lower volatility (leverage can amplify losses and gains).

Also, like stocks, commodities trade on exchanges. Commodity exchanges set roofs and floors for the price fluctuations of commodities and when these limits are hit trading may be halted for a certain time depending on the product traded. The forex and stock market do not have limits that can prevent trading from happening.

One of the primary reasons people prefer to go for demo forex trading is because it allows you to trade with virtual money.To get more news about forex demo and real accounts, you can visit wikifx.com official website.

It helps in training yourself and understanding trading before you choose to invest your hard-earned money. Forex brokers provide demo accounts to the clients. Clients who are new to the industry can learn and improve themselves by trading with these accounts' aid.However, according to studies, even after a person has earned ample experience after trading with these demo accounts, things might turn out to be different as they begin to change with the aid of real funds. Trading with virtual money is more accessible than trading with real money, as you do not need to risk anything.

What is a demo account?

Forex demo account refers to a trial account where investors use a specific amount of virtual money when they are new to trading. It is regarded as an educational tool and provides a risk-free start to trading.In addition to this, you can test your strategies without putting anything to risk at all. Trading in the demo account provides many good services to newbies who otherwise would have lost a lot of real money.

As you choose a demo account, you can learn the tips of watching the market closely. It also offers a better feel and understanding of how the forex market operates without exposing yourself to any risk. In addition to this, it also helps you in learning the latest features of the trading account.

What is a live account?

In the forex live account, you will gain success in depositing and trading with real money. Hence, any profit or loss is going to be accurate as you start to use live accounts. If you are willing to start trading with live accounts, it is necessary to validate them first. However, many forex brokers allow you to deposit the money and begin trading without any validation process.

On the other hand, some people might ask you to verify the account and to do so; you need to address documents and upload Identity proof before you deposit any money and start live trading.

Trade-related differences between live account and demo account

Specific trade-related differences exist between demo and live accounts, resulting in many performance differences while trading. For example, when using a demo account for trading, no emotional commitment is evolved as you are not putting any real money at stake. However, when you are using a live trading account, the traders might experience a psychological block. The fear and worry of losing real money can be distracting and robust.

You will be surprised to know that trading psychology is regarded as one of the primary factors that significantly differentiate between live and demo accounts. As your money is not at a stake while using the demo accounts, you can think clearly and become unemotional and rational. But, as soon as you start using live accounts, everything changes.

However, it is possible to get over these psychological roadblocks and train yourself to remain unemotional and rational. To overcome the transition period, you need to give yourself some time. It is recommended to start trading on live accounts by investing in some accounts and similarly practice a while as you did with your virtual accounts.If a person fails while trading with demo accounts, there are no actual losses. However, the trader might develop certain discipline-related habits, which might cost a lot of money during live trading.

Traders tend to increase risks or overtrade while trading in demo accounts as no stakes are involved. However, it would help if you kept in mind that such behaviors can have serious negative consequences as they plan to use live trading.

There is a wide array of execution issues that account for performance differences between demo and live accounts. For example, a Forex broker generally does not requote a price while using a demo account. However, as they are using live accounts, they might requote the prices often.

The dealing spreads and price feed of demo forex trading are also different from live accounts. In a demo trading account, the broker might go for executing demo stop losses. However, there are increased risks of a considerable amount of slippage when it comes to real trading.

If specific broker errors arise when trading with a live account, it takes a good amount of money, effort, and time to resolve them as they reach out to the forex broker's customer service department.

AvaTrade's holding company is registered in the British Virgin Islands. The firm is headquartered in Dublin, Ireland.To get more news about avatrade pros & cons, you can visit wikifx.com official website.

AvaTrade operates worldwide but operated through regional offices. They serve Australia, South Africa, Singapore, Japan, France, Italy, Spain, Mongolia, China, Abu Dhabi, and more. They serve more than 200,000 active customers and execute 2 million monthly trade orders.

AvaTrade is a platform that provides hundreds of CFD products and a limited number of currency pairs for traders located in more than 120 countries through its two proprietary platforms - Webtrader and AvaOptions - and third-party platforms such as MetaTrader 4 and 5.

The company and its subsidiaries are regulated by various tier-1 and tier-2 jurisdictions such as the Central Bank of Ireland, the Australian Securities and Investments Commission (ASIC), and the Japanese Financial Services Agency (FSA).

Compared to its rivals, AvaTrade's portfolio of available stock, index, and forex CFD is smaller. Their fees for popular instruments and currency pairs such as EUR/USD are a bit higher than the average.Both the proprietary and third-party platforms supported by AvaTrade - MetaTrader 4 and 5 - are excellent, and their features are attractive. No fees are charged for deposits and withdrawals.

AvaTrade's platforms include a web-based and mobile trading app called Webtrader. WebTrader is the company's proprietary trading platform, along with a platform AvaOptions, designed for forex CFD traders.

The web-based platform of AvaTrade, Webtrader, has a user-friendly interface- It allows traders to browse and select the CFDs offered by this trading platform with ease. Prices are displayed next to their ticker symbols along with buy and sell buttons. Traders can tag their favorite securities as some sort of shortcut.

The search function allows the user to search by symbol or name of the asset. The reporting feature provides all the relevant information traders need to analyze their historical transactions. This information includes the market price, realized gains or losses, fees paid, and cost basis.It is important to note that the interface cannot be customized. None of its elements can be moved to suit the users' preferences.

Two-step logins and price alerts are not available. This is a bit disappointing as most platforms send notifications when the price of a security reaches a certain level.

Desktop platform

The desktop platform is similar to the MetaTrader 4 platform. The upside is that it allows for alerts and notifications. Compared to the web-based version, the design of the desktop platform is not as nice. The customization of charts and the interface itself is enabled. The reports section is good, similar to the web-based version. No two-step login is available for the desktop version.

The mobile version of AvaTrade has a good-looking user-friendly interface. It offers a lot, considering the narrow screen space of a mobile phone. The search function works great, and the same goes for the reports function.

There's a unique feature that can be accessed via the mobile app. This is the AvaProtect order, designed to prevent financial losses at an extra fee. AvaOptions has a mobile app version, and they are available for iOs and Android.

AvaSocial - Copy Trading

Avatrade copy trading integrates through DupliTrade and Zulutrade. This ranks them among the best copy trading brokers such as Pepperstone and eToro. Avatrade launched AvaSocial in the UK, with which traders can follow and copy the best traders.

AvaTrade Trading Fees

AvaTrade Trading fees and spreads are competitive and in line with the industry average. The average spread charged S&P 500 index CFD is 0.5, while the average spread charged for trading a Europe 50 index CFD is one pip. The cost of the EURUSD pair is 0.9 pips, right around the industry's average.

To estimate the cost of trading with this broker, we have assumed a hypothetical $2,000 position held for one week with leverage of 20:1 for stock index CFDs and 5:1 for individual stock CFDs.

AvaTrade Research

AvaTrade research tools are good. It includes a news feed, an economic calendar, an idea hub, and many other resources. These are embedded into the broker's platforms - Webtrader, MetaTrader, and AvaOptions.

For trading ideas, AvaTrade offers a section known as ‘Analysts View' or ‘Forex Featured Ideas'. Traders can find hints into potential trading signals spotted by other traders for most of the financial assets covered by the platform.The economic calendar covers a wide range of economic and corporate events around the world, rating them based on the potential impact they may have on the financial markets.

AvaTrade news feed is one of the best out there. It features an excellent visual interface that tracks the number of publications per day, the orientation of such news - positive/negative - and the type of news covered. This feature is known as ‘Market Buzz'.

When day trading foreign exchange (forex) rates, position size, or transaction size in units, is more essential than entry and exit points. This means you'll take on too much or not enough risk depending on how big or small your trades will be.To get more news about forex pivot point calculator, you can visit wikifx.com official website.

Using a free Forex position size calculator, you may precisely assess your risk exposure by determining the number of units or lots that your trade will include. Every major currency pair and cross is supported. Input values are sparse, but the ability to fine-tune it to your individual requirements is there.

To get started, simply enter your information in the fields provided and hit the "Calculate" button.

The number of lots you buy or sell, as well as the type and size of lots, significantly affect the size of your position:

1,000 units of a currency make up a "micro lot"

10,000 units of currency make up a "mini lot"

100,000 units of currency make up a "standard lot"

The ideal position size can be calculated through the following formula:

Pips at risk * pip value * lots traded = amount at risk

Consider this example, if you have a $10,000 account and risk 1% of your account on each trade, a $10,000 account with $10,000 in total. Thus, the maximum amount you can risk per trade is $100. At $1.3051, you decide to purchase the EUR/USD pair and set a stop loss at $1.3041. To put it another way, you're risking $1.3041 ($1.3051 - $1.3041 = $0.0001). Each pip movement is worth $1 because you've been trading mini lots.

If you plug those numbers in the formula, you get:

10 * $1 * lots traded = $100

If you divide both sides of the equation by $10, you arrive at:

Lots traded = 10

10 mini lots are equal to one standard lot, you could buy either 10 minis or one standard.

Another example, you're trading mini lots of the EUR/GBP and you decide to buy at $0.9804 and place a stop loss at $0.9794. That again is 10 pips of risk.

10 * $1.22 * lots traded = $100

The $1.22 value comes from the above conversion formula and this number varies in light of the current exchange rate between the US dollar and the British pound. If you divide both sides of the equation by $12.20, you arrive at:

Lots traded = 8.19

As a result, your position size should be eight mini lots and one micro lot. Using this calculation formula and the 1% rule, you'll be able to accurately determine the lot and position sizes in your forex trading journey.

Global trading platform INFINOX has launched its all-in-one multi-asset trading platform IX One. The user-friendly and fully-customisable platform is packed with essential tools and analysis for traders of any experience.To get more news about infinox, you can visit wikifx.com official website.

These features are available to traders on both mobile and web platforms, where they can trade FX, indices, crypto, equities and more. Accessing the platform is easy as well - the single-step login ensures that traders can get speedy access to the platform.

Furthermore, other popular INFINOX products such as IX Social copy trading are also integrated into the IX One platform.

Adam Saward, Executive Manager and driving force behind IX One said,

"Clients are always looking for more from their broker, and we're extremely proud of INFINOX's ability to recognise this demand and meet it from both a technology and a service point of view."

"With IX One, we've achieved an end-to-end destination for the complete trading experience. The platform packs in trading execution with cutting-edge tools and functionalities, so that traders never have to leave the platform - everything they need is on IX One," Saward added. "We're confident that with the combination of the IX One platform and two of our award winning offerings - trade execution & customer service - we'll be able to provide clients with a compelling trading experience. It's an exciting next step for INFINOX, and we're looking forward to building on this progress throughout the year."

As charging speeds continue to grow each passing month, more makers are looking to get past the 200W threshold and now Infinix is gearing up to launch a phone with 260W wired charging.

We received an image of the upcoming Infinix 260W Thunder Charge charger. The charger is placed next to a phone that resembles the Infinix Zero Ultra which launched with 180W charging capabilities. The new 260W charging system will reportedly bring a four-way 100W charge pump and an AHB (Advanced High-Performance Bus) circuit design with safe charging control.

Our source also mentions that Infinix is testing a 100W wireless charging solution. This one will bring a custom-coil design with improved charging efficiency, reduced internal resistance and increased peak power charging time.

As per the source, Infinix will announce its 260W charging solution a week from now on March 9. It remains to be seen if we'll see a new phone launch alongside the 260W charger or if it will use a modified version of the Infinix Zero Ultra. In all cases Infinix will bring a phone with 260W charger to the market by the end of the year.

Once launched, Infinix will secure the throne as the maker with the fastest charging phone, outpacing Realme which recently debuted its GT Neo5 and Realme GT3 phones that support up to 240W fast charging. We can expect more makers to continue to push the wattage game up until phones can top up their batteries in a matter of seconds.

The $1.6bn lawsuit brought by voting company Dominion against Fox News has done more than threaten the rightwing channel with a historic financial penalty.To get more news about dominion, you can visit wikifx.com official website.

In recent weeks Fox News has also found itself thoroughly, and publicly, embarrassed, as internal messages have revealed not just the extent to which the organization attempted to ignore the actual news in its coverage of the 2020 election, but also the contempt many people within the organization have for Fox News viewers.But whether Fox News wins or loses the defamation lawsuit brought by Dominion - a court hearing is set for 21 March, and a trial is scheduled to start on 17 April - more suffering is likely to come, on multiple fronts.

There's some evidence that Fox News's legendary hold over the Republican party is on the wane, and even speculation that the Murdoch family's position atop the Fox conglomerate could be at risk.

The channel, which was founded by Rupert Murdoch in 1996, has become arguably the most influential media operation in American political history, holding huge sway over the Republican party while maintaining a reputation as a news organization.

But the disclosures released as part of Dominion's suit have put that balance at risk. Dominion lawyers allege Fox News went out of its way to prop up false allegations of fraud, in what appears to have been a concerted effort to prop up the Republican party at the expense of reporting facts.

Messages from the likes of Sean Hannity and Tucker Carlson, Fox News's two biggest stars, showed that many within Fox News did not believe Donald Trump's claims of election fraud in the 2020 election, even as people on the channel continued to cast doubt on the legitimacy of the result.

Rupert Murdoch himself, in a deposition as part of the lawsuit, admitted that several Fox News hosts, including Hannity and Jeanine Pirro, "were endorsing" the lie that the election was stolen from Trump, in spite of all evidence to the contrary.

"What we've seen is a keyhole view into how Fox operates," said Angelo Carusone, president of Media Matters, a watchdog group."What makes all of this so disturbing is that this is about power," he said. "And Fox News at its core is actually a political operation that is designed to give power to the Murdochs."

The exposure of Fox News's internal workings will weaken its reputation as a news organization, Carusone said, and should the channel and its owner, Fox Corporation, lose the Dominion case, there could be immediate financial consequences.

"If they lose the case I think it's going to be really significant. One, it makes shareholder litigation a certainty. Two, it puts Murdoch control of the company in jeopardy."

At least four firms, including Kehoe, which has previously involved in a lawsuit against Bank of America, and Scott+Scott, which was part of a $310m settlement from Google's parent company Alphabet in 2020, have made public appeals for shareholders to approach them to potentially sue Fox Corporation directors and officers for allegedly breaching "their fiduciary duties to Fox and its shareholders".

Allen & Co. Holds Its Annual Sun Valley Conference In Idaho

SUN VALLEY, ID - JULY 11: Lachlan Murdoch, chief executive officer of Fox Corporation and co-chairman of News Corp, attends the annual Allen & Company Sun Valley Conference, July 11, 2019 in Sun Valley, Idaho. Every July, some of the world's most wealthy and powerful business people from the media, finance, and technology spheres converge at the

Rupert Murdoch currently serves as chair of the Fox Corporation board, with his son Lachlan Murdoch as executive chair. Amid the current scandal, however, Carusone said it is possible there could be "a couple of runs at Murdoch control of the company" from aggrieved shareholders.

Fox News could also face problems when it comes to renewing its contracts with cable companies, Carusone said. Cable companies in the US pay individual channels, like Fox News, for the right to include them in their cable packages. Fox News is currently the second most expensive channel, behind ESPN.

Fox News has been able to demand such fees by touting its loyal audience. But messages released as part of the Dominion case have laid bare the contempt some at Fox News have for both their viewers and for Donald Trump, a hero to many in the Fox News audience."Like negotiating with terrorists," Alex Pfeiffer, then a producer on Tucker Carlson's nightly show, said of the line Fox News had to tread between reporting the news and feeding its audience the conspiracy theories they crave.

Vital Essentials, the flagship brand of the Carnivore Meat Company, will unwrap a new look of its award-winning dog and cat food and treats at the Global Pet Expo March 22-24, 2023, at the Orange County Convention Center in Orlando, Florida.To get more news about vital markets, you can visit wikifx.com official website.

Since 2009, Green Bay-based Vital Essentials has been a pioneer in the raw, freeze-dried and frozen pet foods category. Its vast variety of dog and cat food, treat, and supplements are purely raw, ensuring that pets are provided the highest quality whole animal protein available, supporting energetic playtimes; healthier and shinier coats; lean, strong muscles; digestive and oral health; and immune system and heart health. Vital Essentials' new branding underscores the importance of the quality and care in every step of its process. Just as pet owners head to the butcher to procure the finest quality meats for themselves, they have turned to Vital Essentials for the same quality of proteins for their pets. While the new branding and premium kraft paper packaging intentionally has evolved to evoke the experience of visiting a butcher shop, the company's conviction to ultra-premium quality and variety remains the same.

"Vital Essentials boldly entered this market as a trailblazer in the raw pet food category nearly 15 years ago, and this rebrand highlights our continued commitment to enriching the lives of pets and their families worldwide through our cross-category portfolio of brands," said Lanny Viegut, CEO of Vital Essentials. "Ever since we entered the marketplace 15 years ago, we have not wavered on our mission to deliver the finest quality Butcher Cut Protein on the market, and we're especially excited to debut our new branding at the Global Pet Expo, where attendees can see firsthand how we're continually delivering innovation to our customers and retailers nationwide."

From March 22-24, Global Pet Expo attendees are encouraged to visit Vital Essentials at booth #253 to enjoy a first look at the new and improved packaging, meet the team, hear about the brand's exciting new marketing and merchandising initiatives and be among the first to place their wholesale orders. Media is also invited to an intimate and exclusive event at the Expo on Thursday, March 23, at 3 p.m. at the Vital Essentials booth through an interactive demonstration about the quality and benefits of butcher-cut protein and the difference it can make in a pet's life.

British Virgin Islands Financial Services Commission (BVIFSC) regulates the financial markets. Forex trading brokers get license from BVI FSC regulator to confirm the legality and transparency of the services provided. The companies that have permits from this regulator include such well-known intermediaries as Forex4you, FIBO Group, RVD Markets and other brokers. BVI Financial Services Commission closely monitors the activities of its participants. Due to this, the BVI FSC Forex brokers are suitable for successful trading.To get more news about fsc regulated forex brokers, you can visit wikifx.com official website.

WORK THROUGH TRUSTED INTERMEDIARIES

BVI FSC was founded in 2001. The British Virgin Islands Financial Services Commission declared its main task as the need to ensure comprehensive protection of investors, shareholders and other financial market participants from fraud and other illegal activities. Following these principles, Forex trading brokers fall under a constant monitoring from BVI FSC regardless of the size of the charter capital, the number of customers and other factors and characteristics of the regulated companies. In its work, the BVI Financial Services Commission is guided by the recommendations of the FATF and OECD, expanding its own regulatory function at the national level.

The BVIFSC regulator seeks to position the BVI as the upscale center of financial services. Therefore, the presence of the BVI FSC license is an important competitive advantage for each broker trading on the Forex market. All tried and tested brokers regulated by this British Virgin Islands Financial Services Commission are included in this rating from TopBrokers.com. Comprehensive information, testimonials from real traders and other useful information will help you find and select suitable BVI FSC Forex Trading brokers.

Australia's superannuation funds are on the cusp of an historic shift to having more than half of their assets invested offshore, according to a NAB survey published today.To get more news about forex field survey, you can visit wikifx.com official website.

The NAB 2021 Superannuation FX Survey found that allocations to offshore investments jumped from 41% to 46.8% on average over the past two financial years, with 61% of funds reporting plans to further increase the amount invested in foreign assets.

NAB Markets Executive General Manager Drew Bradford said findings reveal some funds have already crossed the 50% threshold for the first time.

"This survey shows the move to increase offshore investments is continuing and funds are taking on more foreign currency exposure," Mr Bradford said.

"Notably, many public sector funds have crossed the 50% threshold for the first time within the past two financial years.

"Currency is now the biggest investment risk in the portfolio after equity market risk and super funds are increasingly treating foreign exchange as an asset allocation, just as they would for any other asset class.

"What's really interesting is that funds have started hedging more of that risk - reversing earlier declines - but continue to move away from traditional hedge ratios that used to dominate their offshore investments."

The NAB 2021 Superannuation Fund FX Survey of 54 industry, corporate, retail, and public sector funds managing $1.81 trillion of Australians' superannuation assets is NAB's 10th biennial survey tracking the hedging practices of the industry. It covers a tumultuous period that included both waves of the COVID-19 pandemic, currency volatility in early 2020, the early release super scheme designed to buffer household incomes, the acceleration of fund mergers and the introduction of the ‘Your Future, Your Super' reforms.

Large super funds were the most inclined to increase their exposure to international equities, according to 75% of survey respondents. They cited the breadth of opportunities relative to the domestic market, more attractive pricing, and the desire to follow peer group asset allocations among their key motivations for allocating funds offshore.

The survey found that as funds were moving offshore, they were also seeking more exposure to unlisted assets with private markets - including debt - unlisted real estate and infrastructure among their favoured targets.

The recently introduced ‘Your Future, Your Super' reforms designed to improve the accountability of funds have also become a significant factor in managers thinking about foreign currency. The reforms allocate pass or fail marks against set of benchmarks set by the Australian Prudential Regulation Authority (APRA) and are expected to lead to greater scrutiny and ongoing monitoring of currency effects on performance. APRA assumes funds fully hedge international exposures to fixed income, property, and infrastructure while ‘other' assets are assumed to be 75% hedged.

Association of Superannuation Funds of Australia Chief Executive, Dr Martin Fahy said the survey findings provided valuable insights into the trends shaping returns across the $2.26 trillion super industry.

"The rise of allocations to international assets shows no sign of slowing and has been a significant factor in the high investment returns funds have enjoyed for the past two years. That this trend has continued through the unprecedented dislocations suffered by the global economy due to the pandemic is testament to the systems and people in place to protect and grow Australia's retirement savings," Dr Fahy said.

Amid continuing mergers, many funds have continued to build their in-house investment capability and these teams are more influential than ever in currency decisions, the survey reported. They showed their worth in the initial stages of the pandemic when decisions about hedging and rebalancing portfolios needed to be made quickly.

As of 23 September 2022, MT4 is no longer available in the App Store for iPhones and iPads. Clients with a pre-installed MT4 app will no longer receive updates, and new users will not be able to download the app to their iOS devices.To get more news about best mt4 forex brokers, you can visit wikifx.com official website.

MT5 is slowly replacing the MT4 trading platform, but it is still the most popular trading platform in the world, and most good Forex brokers in India will offer it.

Because so many brokers offer MT4, we look for the widest range of top-quality MT4 brokers for a variety of trading priorities and budgets. We compared trading costs, execution speed, and the number of Forex pairs the brokers offered. We also tested the brokers' technical customer support quality and ensured they were fully regulated to ensure trader safety. Under the list of best MT4 brokers, common questions will also be answered, such as: What is MT4? How does MT4 work? How is it different from other trading platforms like MT5 and cTrader? And how to automate trading with Expert Advisors?

How to compare MT4 Brokers

When setting up a trading account, it is common for a broker to support various trading platforms. As you compare brokers, it is important to pay special attention to factors that set these MT4 accounts apart from the accounts offered connected with other trading platforms. To compare MT4 Forex brokers, we need to consider the following:

MT4 account types: While a broker will support MT4, brokers often have multiple account types, and it could be that not all account types will allow you to trade using the MT4 platform. If you intend to use MT4, verify the account that best suits you also supports MT4.

MT4 trade execution and conditions: Be sure to check the trading conditions of your MT4 account. The trade execution method, speed of execution, and the trading costs of your trade can all be impacted by the platform and account combination. As you choose your MT4 account, be sure to verify the conditions against what was advertised.

MT4 tools and plugins: The occasional broker offers plugins and tools for the platform. Axi offers Psyquation and Autochartist to clients for free, while Admirals, through cooperation with MetaQuotes, built MT4 Supreme Edition. These additions to the platform change the trading experience and add additional benefits to the trading platform.

MT4 support: Setting up a trading platform like MT4 can take time to install and customize. Select brokers will offer their assistance, which can be helpful for beginners. Be aware that some brokers have limited customer service hours, especially on weekends, so finding a broker whose customer service hours suit you.

XM - Best MT4 Education

An multi-regulated market-maker with tight spreads over three simple account types, XM stands out from a crowded field of MT4 brokers for its educational support and customer service. XM's MT4 video tutorials guide new traders through all the important features of XM's MT4 platform. Tutorials cover most things from opening a trading account to understanding pending orders and backtesting Expert Advisors.

All MT4 accounts have a max leverage 30:1, negative balance protection, and minimum deposits start from 5 USD. XM MT4 spreads are as low as 0.6 pips, and 99.35% of all trades are executed in less than 1 second. XM also has a strict no-requotes/rejection policy, which means that all trades are always filled at the price expected. MT4 users can trade Forex, stock indices, precious metals, and energies.

Themed "WikiFX Attracts Global Attention with Data and Wisdom", the grand summit kicked off in Shanghai on February 13, as WikiFX joined hands with the best security brokers and important guests from the forex industry to discuss the value of financial data, and international forex development strategies.To get more news about wikifx app, you can visit wikifx.com official website.

WikiFX, a top-notch young company providing a transformative financial app, has released the full international version with languages, providing users with trends and updates in the forex sector, help in avoiding fraudulent brokers, and offering advice for the never-ending problems facing all investors.

Finding the right Forex broker is crucial especially for the newbie trader, in order that he learn the proper techniques of trading, able to safeguard his money, and compound his investments. This is where WikiFX stands tall, as a platform for finding the best brokers, now established in its full international version.

The aim of the platform is to offer users actionable insights about brokers. Through detailed services like correlated broker inquiries, downloadable credit reports, complaint and safeguard, broker monitoring, broker identification, credit assessment, risk exploration and many other services on this platform, to help with their trading.

The WikiFX platform covers a wide range of broker ratings directly from regulators, local governments and overseas markets. It has already rated more than 5000 foreign exchange brokers from 100 nations, and gathered the qualifications of nearly 80% of brokers at the international level, from 120 national regulators.

WikiFX ratings given to brokers are essentially recognized by regulators worldwide, lending support to the WikiFX international version, and the new App as it takes to the international market and becomes available as the "WikiFX App" on Google Play and the Apple Store.

App users can set up private accounts with their preferred transactions, search for credit assessments of brokers through the platform, and receive a quantitative assessment of the regulations of each broker. In other words, as a platform to help traders, it is also highly credible and globally influential.

The 2019 WIKIFX SYDNEY SUMMIT, regarded as a top annual event by the international Forex industry, will be hosted by WikiFX on 1st March in Sydney, Australia. Many influential Forex elites will be speaking at the event and sharing Forex experiences, while Forex investors worldwide are invited to attend, participate and enjoy!

Forex trading among retail investors and traders in Australia is on the rise as this huge financial market expands in the country and globally. Many currencies trade in the forex market, and the Australian dollar (AUD) - also known by its nickname "the Aussie" - is among them. This currency is issued and managed by the Reserve Bank of Australia (RBA) which acts as the country's central bank. To get more news about asic regulated forex brokers, you can visit wikifx.com official website.

Furthermore, the Bank for International Settlements (BIS) ranked the AUD 5th among April 2016's most actively traded currencies when it then made up 6.9 percent of forex market turnover. The AUD was also ranked 6th among currencies held as central bank reserves, making up 1.5 percent of Q3 2018 reserves, according to the International Monetary Fund (IMF).

6 Best ASIC-Regulated Forex Brokers

Each of the top ASIC-regulated forex brokers listed below accepts Australian clients. Although forex traders based in Australia will typically select an ASIC-regulated broker to deal through for their own protection, other international brokers may also accept them as clients.

When selecting the best online brokerage firms regulated by ASIC, keep in mind the broker you choose is as important as how you trade. Also, the amount of leverage you can use, the assets you can trade, the available trading software and the required amount for a minimum margin deposit can vary substantially between brokers, so review each broker carefully to make sure they can fulfill your requirements.

1. Best for Access to Foreign Markets: Interactive Brokers

Interactive Brokers is a top U.S.-based online broker that was founded in 1977. It allows you to trade more than 120 world markets, including stocks listed on the Australian Stock Exchange (ASX). Regulated in the U.S. by the National Futures Association (NFA) and the Commodity Futures Trading Commission (CFTC), Interactive Brokers accepts clients from Australia via its Interactive Brokers Australia Pty Ltd. subsidiary which is duly regulated by ASIC.

In addition to forex pairs, Interactive Brokers lets you trade stocks, futures, options and options on futures, bonds and funds. Its top-rated trading platform TraderWorkstation (TWS) is available in both Windows and Mac versions and is geared toward professional traders. Interactive Brokers also offers a mobile option for iOS and Android, as well as a more basic trading platform called Client Portal.

Although you might find the Interactive Brokers commission schedule somewhat complex, its fees are competitive to suit high-volume trading. It also offers extensive research and educational materials for traders who need that. This broker does charge a fee for inactive accounts.

2. Best for US Clients: FOREX.com

FOREX.com is the leading online forex broker in the U.S. for client assets. It submits to strict regulation under the CFTC and NFA, as well as ASIC and accepts Australian clients.

You will need a minimum deposit of $250 to open a trading account at FOREX.com. Although the maximum leverage ratio is only 50 to 1, you can trade micro-lots if you want to take the lower risk to start with.

With respect to trading platforms, FOREX.com offers its own proprietary trading platform and also lets you use Metatrader 4 or 5 (MT4/5) and NinjaTrader. The broker supports platforms for trading on desktop, web-based or mobile devices.

3. Best in Australia: Vantage

Vantage is a forex trader and CFD market for anyone in Australia. You can also trade indices, commodities and cryptocurrency if you like. With quality liquidity and the capacity to handle high volume traders, Vantage also offers:

4. Best for Low Deposits: Plus 500

You do not own or have any rights to the underlying assets. Consider if you fall within our Target Market Distribution. Please refer to the Disclosure documents available on their website.

In order to trade in a real trading account you will need to complete the registration, fill in the questionnaire, verify your account and deposit $100 to get started with an account at Plus500. You can trade an exceptionally wide range of more than 2,500 assets on CFDs. The broker does not provide support for MT4/5, and its proprietary trading platforms have similar functionality but lack the user base and third party software that MT4/5 is so popular for.

5. Best for MetaTrader4 Users: IG

Founded in 1974 in the UK, IG is an online forex and CFD broker that also offers spread betting. It is regulated by the FCA in the UK and by ASIC in Australia, and it accepts Australian clients.

IG uses a popular broker model that features straight through processing (STP) for order execution and it offers direct market access (DMA) for share trading.

You'll need at least 0 to open a trading account with IG that will let you trade forex, shares, commodities, exchange-traded funds (ETFs), cryptocurrencies and indices. Its supported 3rd-party trading platforms include MT4, and the broker also offers its proprietary app for mobile trading app and a web-based trading platform.

The Financial Services Commission (FSC) of the British Virgin Islands (BVI) is the supervisory authority responsible for overseeing and regulating the financial services industry in the British Virgin Islands, a is a popular offshore jurisdiction. Due to its tax rate structure, the BVI has become one of the known places for Financial Investment firms.To get more news about fsc regulated forex brokers, you can visit wikifx.com official website.

BVI FSC Forex Trading Platform

Forex Trading is legal and regulated in the British Virgin Islands (BVI). IIn fact, many forex brokers choose to register and operate from the BVI due to its favorable business environment, which includes a relatively low tax regime and a flexible regulatory framework allowing to accept traders from around the world. Yet, BVI is an offshore zone which is hardly compared for its transparency and sharp rules to reputable jurisdiction like US, UK or Australia.

The Financial Services Commission (FSC) is the regulatory body responsible for overseeing the financial services sector in the BVI, including forex trading activities.

Forex brokers and platforms operating in the BVI need to be licensed by the FSC and comply with their regulations

Although forex trading is legal in the BVI, the regulations are considered low compared to top-tier and reputable financial Regulators worldwide. That is why it is essential for traders to exercise caution and do deep research before selecting a broker, as the level of regulatory oversight might differ from more stringent jurisdictions. (For example, Read Why Trade with UK FCA Regulated Brokers)

The British Virgin Islands FSC Regulation

The British Virgin Islands is considered an offshore financial center, and the Financial Services Commission is the regulatory body that oversees the financial services sector within the territory. The FSC's role is to ensure that the BVI's financial services industry operates within the established regulatory framework and adheres to international standards while providing financial services to non-residents, which is characteristic of offshore jurisdictions.

FSC regulatory body was established in 2001 under the Financial Services Commission Act, 2001, and is now handling all the responsibilities previously held by the government through the Financial Services Department. It serves as an autonomous regulatory authority for the financial services industry in the British Virgin Islands.

Generally, the FSC's responsibilities are to ensure compliance with laws, secure and maintain transparent operations along with investors' protection. FSCBVI integrates financial market participants in a fair environment through certain threshold conditions.

However, BVI and any other offshore zone is highest risk zones, since many unscrupulous Brokers establish their entities here too. So in case Brokers is solely BVI regulated Broker it is high risk to be a scam Forex.